Introduction

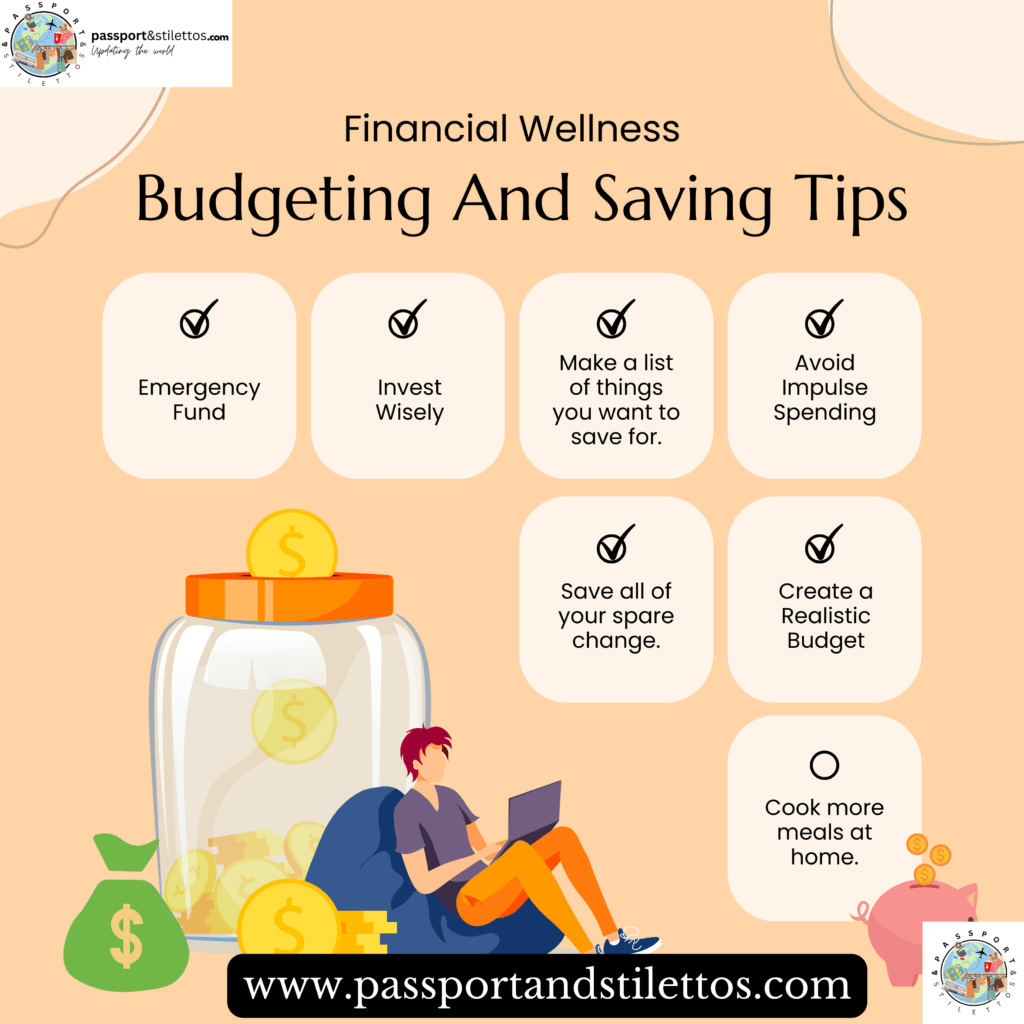

Welcome back, fellow adventurers at PassportandStilettos.com! As globetrotters, we cherish unforgettable experiences and breathtaking destinations. However, financial wellness is an essential aspect of our journey to ensure we can keep exploring the world while maintaining a stable financial foundation. In this blog post, we’ll delve into the art of budgeting, a powerful tool to help us achieve our travel dreams while still securing our financial future. So, let’s embark on this financial adventure and discover effective budgeting and saving tips!

1.Understanding the Importance of Budgeting

Budgeting is the backbone of financial wellness. It empowers us to take control of our finances and allocate our hard-earned money wisely. A budget serves as a roadmap, guiding us towards our goals, be it travel, investments, or building an emergency fund. By tracking expenses and income, we can identify areas where we overspend and opportunities for saving more.

2.Create a Realistic Budget

To start budgeting, it’s crucial to create a realistic budget tailored to your unique lifestyle and financial goals. Begin by listing all your sources of income, including salary, freelance earnings, or passive income streams. Then, analyze your expenses over the past few months and categorize them into essential (e.g., rent, groceries, utilities) and non-essential (e.g., dining out, entertainment) expenses.

With a clear understanding of your finances, set realistic limits for each expense category. Ensure that your total expenses do not exceed your total income, and allocate a portion of your income towards savings and investments.

3.Track Your Spending

Tracking your spending is the key to staying on top of your budget. Consider using budgeting apps or spreadsheets to record your daily expenses. Many apps automatically categorize expenses, making it easier to identify areas where you may be overspending. By being aware of your spending patterns, you can make informed decisions about adjusting your budget to align with your financial goals.

4.Embrace the Envelope Method

If you struggle to control impulse spending, the envelope method can be a game-changer. Allocate cash for specific expense categories, such as groceries, entertainment, or dining out. Label envelopes accordingly and put the designated amount of cash in each envelope at the beginning of the month. When the envelope is empty, you know you’ve reached your limit for that category until the next month.

5.Prioritize Debt Repayment

Managing debt is a vital aspect of financial wellness. High-interest debts, such as credit card debt, can quickly accumulate and hinder your ability to save and travel. Make debt repayment a priority and focus on eliminating high-interest debts first. Consider consolidating debts or negotiating lower interest rates to ease the burden.

6.Save for the Unexpected

Life is unpredictable, and unexpected expenses can occur at any time. It’s essential to have an emergency fund to cover such situations without disrupting your long-term financial plans. Aim to save at least three to six months’ worth of living expenses in an easily accessible account.

7.Automate Your Savings

Automating your savings is a simple yet powerful strategy. Set up automatic transfers from your checking account to your savings or investment accounts on payday. This way, you save before you have the chance to spend impulsively. It’s an effective way to build up your savings without much effort.

8.Review and Adjust Regularly

Financial circumstances change over time, and so should your budget. Review your budget regularly, preferably every month, to evaluate your progress, identify areas for improvement, and make necessary adjustments. Life events, such as a pay raise, new job, or major expenses, may require budget modifications.

Conclusion

By mastering the art of budgeting, you can achieve financial wellness and still fulfill your travel dreams. Remember, budgeting isn’t about depriving yourself; it’s about making conscious choices to align your spending with your priorities. Stay committed to your financial goals, and you’ll soon find yourself exploring new destinations with the peace of mind that your financial future is secure.

Embark on this journey to financial wellness today and embrace the freedom that comes with responsible budgeting. Safe travels, adventurers!

Also Read:

- 5 Best Road Trip To Take in India

- Captivating Review on The Summer I Turned Pretty by Jenny Han 2022

- Financial Wellness: Budgeting and Saving Tips

- Celebrating Bonds of Joy: Friendship Day Delights 2023

- Celebrating Feline Majesty: International Cat’s Day 2023

- Celebrating International Biodiesel Day 2023: Fuelling a Greener Tomorrow

- Embracing the Beautiful Chaos of “It’s Okay to Not Be Okay” (2020)- A Thought-Provoking Review

- Navigating Financial Horizons: A mind – blowing review on Oppenheimer

Written by: Anshika Patra